Update: All tariffs on European wine have been suspended. Learn more.

Imagine this: you go to your local wine shop to stock up. You go to the Italian wine section where the Nebbiolo Langhe you always buy now costs $42. That same producer’s Barolo is now $105. In fact, every Barolo is now three figures.

So, empty-handed, you head to Spain, which is always good for value. But when you grab a Ribera del Duero, you see it’s now $44. And you can’t bring yourself to spend $19 on the fruity, mass-produced Garnacha that’s become your weekday guilty pleasure. It’s good, but not $19 good.

How about French rosé? You’re now lucky to find one under $35.

Champagne? $75 won’t even get you a good bottle.

And lo and behold, even the California wine selection seems thinner. The distributor who brings a great selection of Sonoma Coast Pinot Noir to your state has suddenly gone belly up. They were “over-leveraged” in the world’s three largest wine producing countries — Italy, France and Spain — all of which now face 100% tariffs.

Is this the future of wine shopping in America?

If a current proposal by the Trump Administration to impose 100% tariffs on most European Union food items — including all wine — goes through, it could be. We can split hairs on what the exact price of things would be, but that actually misses the point. The more likely scenario is that once inventories are used up, these wines will simply no longer come to America at all.

That would be a tragic and self-inflicted wound to us as consumers, but it will be far more painful for American workers.

I do not doubt that the United States and Europe have some serious trade issues that need to be ironed out. I applaud anyone who wants to wade into that morass and negotiate a resolution. But this doesn’t strike me as the best way. At all.

So you know, I am a political moderate. I’ve never been inclined to do the bidding of partisans, and while I have my own passionate opinions about the way things should be with our government, this site has never been the place for it.

But this action lies at the heart of what Opening a Bottle — and the industry that inspires it — is all about. I cannot sit this one out, and if you are a Republican (or Democrat) who loves wine and a strong American workforce, I don’t think you can either.

So What Exactly is Going On?

These tariffs are being considered because Boeing and Airbus have been feuding within the WTO for over a decade on unfair business practices (namely, subsidies the EU provides to keep Airbus running). The WTO has finally sided with Boeing, which has been seen as a green light by the U.S. Government to take retribution against the European Union.

But rather than strike solely the European aviation industry, the current administration has decided to hit something much more symbolic (and less politically organized and powerful): the producers responsible for Europe’s great culinary heritage. Wine will be caught up along with cheeses, meats, olive oils, produce and whiskeys as well as other industries known for contributing to global culture, such as clothing, ceramics and art.

I suspect these industries are an easy target for our administration because, let’s be honest, (a) Trump relishes any chance to be seen as anti-elite (and what could be more elitist than wine?) and (b) these tariffs pit European Union member nations against each other. The first round of tariffs in the fall underscored this last tactic: non-sparkling wines under 14% alcohol from France, Germany, the UK and Spain were hit with a 25% tariff, but Italian wines were spared. Italian meats and cheeses, however, were not. It was as though they wanted each member nation to feel the hurt in a different way.

What Happens If This Goes Through?

But the hurt has already been felt on this side of the Atlantic, and no dose of painkiller can handle the kind of hurt that will be imposed by the 100% tariff, if it goes through.

Many of my friends are in the wine importation, distribution and retail/restaurant space here in America, and a tariff this steep will essentially shut that market down, and decimate the employment prospects of many. Here’s how the dominoes will fall.

Importers

Look at the label on the last bottle of European wine that you bought, and see who imported it. Then go to their website and see how diversified their portfolio is. Many of America’s best importers have become that way because they’ve specialized and narrowed their focus to bring us the best. They have the ability to educate the American marketplace on what these wines are and why they matter, and because of that, Europe’s best producers work with them.

Even if you are not bothered by paying “a little extra” for your wine, these companies will be, and odds are, they won’t be able to make it work any more. Those wines will cease to be available. Where will they go? If I had to guess, it would most likely be China, a market that has an insatiable thirst for these wines.

Distributors

And how about the people who bring the wines to market from the importers? Their business model runs on economies of scale, and so even if they have a domestic distribution portfolio as well, wines from France, Italy, Spain, Germany and Portugal account for a significant cross-section. There will undoubtedly be layoffs at such a company, or — in the case of distributors with a specialized focus — entire companies will go under.

Remember: these are American companies employing Americans.

Restaurants & Retail

By now, a picture of economic carnage is starting to emerge, but I think it could get worse once it rolls into restaurants and retail.

Imagine you are an Italian restaurant. You’ve built a reputation over the years for Italian-style hospitality and for being generous with your Parmigiano-Reggiano shavings on the pasta. You might even bring some of Italy’s more noteworthy winemakers to town. How do you survive 100% tariffs on the very ingredients that power your restaurant? How do you preserve your reputation for authenticity?

However, the bleakest picture could very well be your local wine shop. Retail is a brutal business, and inventory management is a not-so-glamorous but carefully balanced ballet. How is a brick-and-mortar wine shop to survive if the distributors cut back and the great importers go out of business? What can they offer that you won’t be able to find (for cheaper) at a big-box liquor mart, a grocery store, or even Amazon?

American Wineries

So, we’ll just buy American wine, you might suggest. They stand to gain the most from this action, right?

Not necessarily. There is good reason to believe this move will even hurt the American wine industry. Wine is seen as a “nicety” in many ways. It may seem essential to you and me, but to the broader public it is still considered a luxury. Because of this, it competes with other alcohols, not necessarily within itself, across national lines.

As a result, all wineries — American or otherwise — require a constant influx of new consumers to stay vital. Italy, France and Spain are the three largest wine producing nations in the world. Together, they account for more than 50% of the world’s wine exports. Currently, they are supremely represented in the American marketplace, and they are responsible for introducing many young wine drinkers to the joys of the drink. Without an even decent (let alone excellent) representation of these wines, the consumer base for American wineries will shrink. And that doesn’t even account for the loss of business on the export market for American wines, who will undoubtedly feel retribution.

European Producers

On an intellectual level, there is more than enough evidence to oppose these tariffs because of what they will do to American jobs.

But on a personal level, I also have concern for what this will do to the many wonderful producers I’ve met in Italy and France over the years, who are already grappling with lower yields and unpredictable changes to the climate. They have already endured so much. Time and again, their love and admiration of the American wine consumer — and our savvy with wine and global cuisine — is evident when I talk to them. They want to continue selling their wine here. They would hate for these connections to be broken up, least in part because of the hard work they’ve put into educating us.

As one small example, it has taken Nebbiolo decades to earn name-recognition as a grape in this country. Barolo and Barbaresco producers did much of that by coming over here and speaking passionately about it on a one-on-one basis at restaurants and wine shops. They don’t want to take their wines elsewhere, but if it no longer adds up in America because of the 100% tariffs, they will have to. And the place they’ll likely go — as I said before — is China, where the market is insatiable and the potential for growth is enormous.

If that happens, would we ever get these wines back, even if the administration — or the next one — negotiates a deal and eventually drops the tariffs?

What You Can Do About It

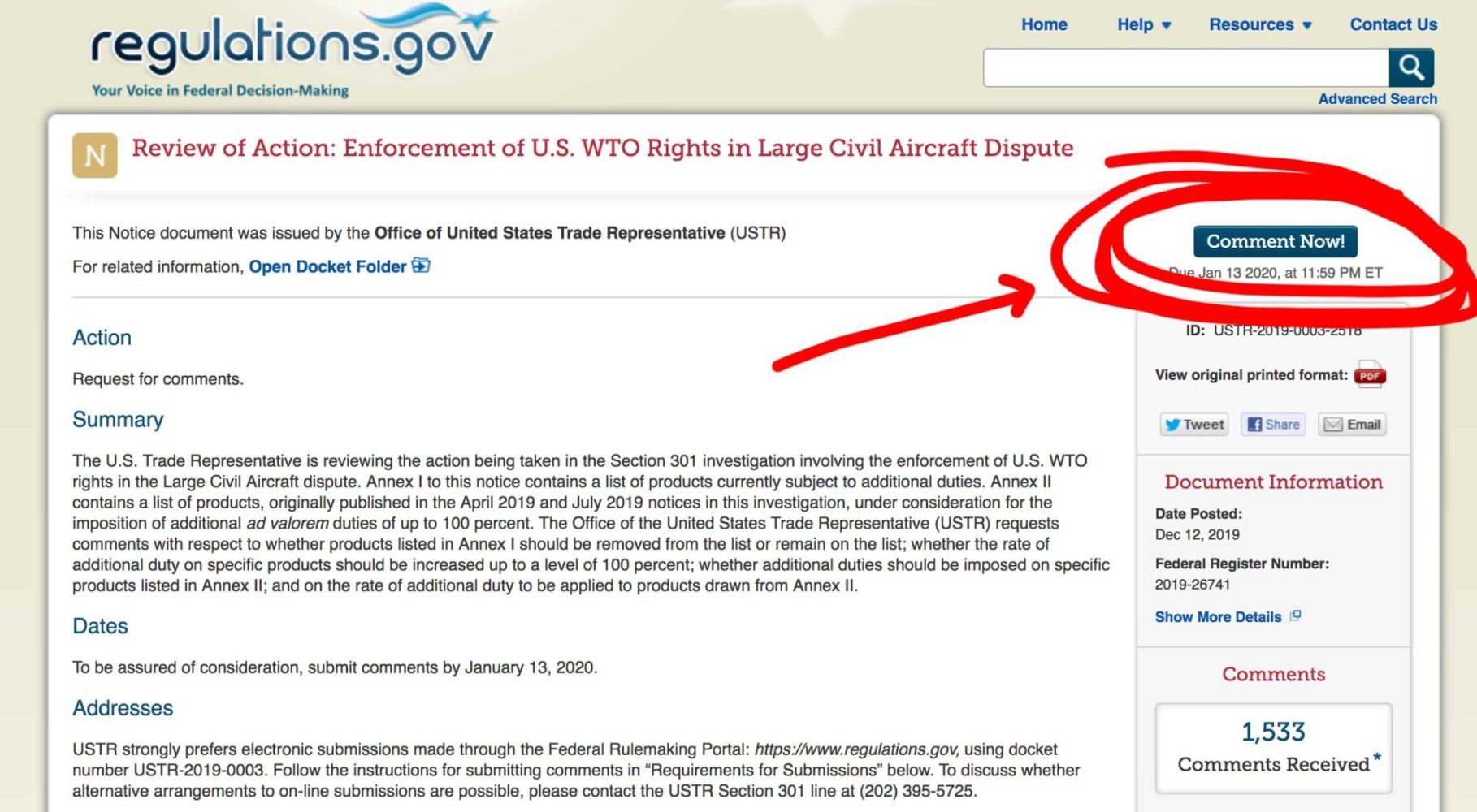

There is still time, but the deadline to comment on this momentous policy is January 13, 2020.

Over the holidays, you will have a spare five minutes I am sure. Pour yourself a glass of Amarone and visit Regulations.gov to comment on these proposed tariffs. Click the blue “Comment Now!” button in the upper right (see below). Keep it short and concise if you have to. Any comment will go a long way.

If you are in the wine industry, be sure to address how this affects you personally. If you have to flatter Donald’s ego in doing so, go for it. I won’t judge. Sometimes you have to know your audience, and its his loyalists who need to be swayed.

Emphasize how this effort hurts American jobs. How it hurts our ability to buy what we want. How it makes us less like the America we see as our ideal. Or make a point that I’ve somehow missed.

And if you are on the other side of the Atlantic, encourage your leaders to negotiate a deal to keep these industries thriving.

Yes, it’s just wine, but as you know, dear wine lover, this drink has a special power, and I’m not talking about the alcohol. Let’s preserve the American marketplace and flood the following web pages with our candid opinions. Currently, there are only 1,533 comments. That ought to be 500,000 at least.

Amazing post. So well structured and so thoughtful. The wine industry print magazines don’t come close to the job you’ve done here putting this all in perspective. And you are so right, we cannot sit this one out. Well done, Kevin! Well done.

Thank you, Suzanne. I wish I had more time to get stats and facts and figures and quotes from the industry into the piece, but this one has some urgency so I needed to get it out there.

This is great work, Kevin. It is incredibly user-friendly and clearly written… one of the best breakdowns I’ve seen regarding the potential impact of the increased tariffs. The wine industry needs allies outside of the business and your article will help bridge that gap. I’ve shared it to social media and have encouraged all of my friends outside the wine industry to do the same.

Thank you, Rebecca. I am glad it has proven useful for the industry. I encountered what we are up against last night when a commentator on Instagram noted that “aerospace is more important than wine.” We had quite the give and take, and while I was frustrated (and ultimately unconvinced by his points), it helped me see a perspective from the opposition, which we haven’t heard much from in the media or online. The tariffs seem punitive and mean-spirited without this perspective. (And hearing “wine cave” tossed around like it was a four-letter word last night in the debate wasn’t helpful for our image either). I think the wine industry would be wise to take stock of the opposition’s points (essentially, the EU owes us, and without them writing a check to the Treasury, the only way to reclaim the settlement is through tariffs) so that we can counter those points and win this debate. Which I think we can if we play our cards right.

I agree that we should ALWAYS take stock of our opposition’s points. Unfortunately, it’s the importers (us! companies in the US!) who have to pay the tariff bill. The tariff was set to affect 7.5 billion dollars worth of European goods. With more than a 2x price increases on wine, cheese and everything else, there is no way that dollar amount of goods will be brought in to the country …. so there will be significantly less “settlement” available. In that light, the tariff seems especially punitive and mean-spirited.

Yes, yes and yes. This is what I’m talking about in terms of winning the debate. Very good points, especially on not reaching the “settlement” in the first place because the products won’t even come in. The whole endeavor is misguided and daft.

I totally agree, Rebecca. This needs to be widely circulated. I haven’t seen anything like this in the mainstream and wine industry print media, so I’ve tried to share as much as possible. Hopefully Santa Claus will bring us some clarity and fewer sleepless nights over this issue in the New Year.

Well written piece on this insane twist in us trade policy. I was sent a link by a friend in the wine industry. It kills me that our gov’t has been warped by such ridiculous idiots. I will post comments on the regulations site and contact my congress critters. Thanks for getting the word out!

Thank you, David.

This problem affects me on many levels, 1- the disappointment with this administration and their inability to keep foreign relations, and their readiness to pass on tariffs to Americans; 2-the fact I may have to pay double to enjoy a nice bottle of wine and 3- I have friends in the beverage industry who work very hard to educate customers and experience the best wines the world has to offer, and they are worried they may not have a career if this goes through. It’s not ok!

Thank you Carrie, for your support on this. I hope you have time to leave your comments with the Federal government website. Need all the support we can get.

This will probably affect the tip percentages the servers get as well. Someone like myself may go out to eat a few times a year and treat myself to a mice glass of wine. I may second guess that and either not have a glass, or if I do I won’t be splurging on dinner too. I might be apt to not leave as big of a tip as before either since I may have budgeted so much for that special dinner and got a big surprise that my $10 glass of wine is now $20!

I think you outline very well the quiet, not-so-obvious “drip, drip, drip” impact of this on the economy. It is very subtle, but has the potential to be vastly devastating. Thanks for your support, and please comment on the USTR website, too. Cheers.

Thank you for writing this, Kevin, and for making me aware of the opportunity to comment. Wine is unique in its ability to connect us with other people and cultures. Regardless of the merit or intentions of the proposed tariff, the repercussions would go far beyond politics and would have a very tangible impact on the world (including the US) economy and quality of life.

Thanks, Sam. I agree, and I’m glad the piece was able to shed some light on it. Please leave comment with the USTR website. Much appreciated!

Thank you for this very thoughtful and well written article on the effects of the Trump tariff. European farmers and winegrowers are not industry and the David and Goliath scenario is not appropriate. The job losses in the United States will be felt cross country.

Thank you. I am honored that you read my article and that you found it on point. I am familiar with all the work you’ve done over many years to cultivate a robust wine trade between the United States and Europe, as well as to educate the American wine drinker on the joys and simple pleasures of wine. As a fan of wine, I thank you for that! I share your concern deeply. Please let me know if you see any other way that I can help communicate on this issue.

This trade policy choice, and of course it is a choice, actually makes a lot of sense from the broader perspective.

Disclaimer: I happened across this post because it was posted by a local restaurant I like. I am not much of a wine drinker. I have a long interest in the aerospace industry but don’t work in it.

First, consider what tariffs are for: they are a means of leverage to get your trade partner to do, or not do, what you want. For a tariff to be effective, then, it must have an impact. Now consider the political leverage that the agricultural bloc has in France, Spain, and Italy. A quick google for “french farmer strike,” for example, will show that the farmers and food producers there are far more politically active, and much more influential, than most people in the US realize. On the one hand, you have Airbus. On the other hand, you have hundreds of thousands of farmers and tens of millions of people directly affected by farm strikes, highway blockages, etc. The Macron government in particular has shown itself very attuned to this sort of public pressure (hellllloooo Gilets Jaunes!) If tariffs are meant to impose one country’s economic will on another, then it’s far more effective to target them this way, especially given the national willingness of the French and Italians to strike over exactly this kind of thing.

Second, consider the actual size of the market. If I am reading the graph at https://ec.europa.eu/info/sites/info/files/food-farming-fisheries/farming/documents/wine-dashboard_en.pdf correctly, the EU exported just under EUR 4bn of wine to the US in 2018. I spent a few minutes looking around for updated figures but didn’t find anything authoritative, but Wikipedia shows the overall French-only aerospace export market at about EUR 49bn. Take out all the non-Airbus, non-US exports and I would still bet that it’s easily double or triple that EUR 4bn wine figure, and that’s just from France. A 10% tariff on Airbus alone would raise far more money than the food tariffs, but remember– the tariffs aren’t about raising money for the country that imposes them.

Third, let’s talk about the “insatiable” Chinese market. As we have seen with oil, cement, and many other materials, when the Chinese want to buy a lot of something, they do. So if their demand for wine was that high, they’d already be buying it. Yet the EU’s own statistics (https://ec.europa.eu/info/sites/info/files/food-farming-fisheries/farming/documents/wine-trade-2018_en_0.pdf) show that the US imports roughly 2x as much wine as China by volume, and 4x by value– so the US is not only buying more wine, it’s buying more expensive wine. It doesn’t seem likely to be that a drop in exports to the US brought on by tariffs will be matched by a surge of importation in China unless it’s also accompanied by a price drop. If the Chinese market wanted those premium or more expensive wines, the ex/im statistics would look very different than they do now.

Finally, and most importantly to me, this whole post does a great job of pointing out the impact of these tariffs on people associated with the wine industry. It says nothing about the millions of Americans who have been impacted by the illegal subsidies to Airbus. The men and women who work on the factory floors of the US aerospace industry– the people who design, fabricate, build, and test all the components that go into US-based aircraft, helicopters, and space vehicles– deserve the interest and protection of our government. They may be drinking Natural Light instead of imported wine (or maybe not, what the hell do I know) but I think the US government is right to prioritize their economic interest above the interest of farmers and vintners in Italy. That there are other Americans negatively affected by this decision is sad and unfortunate, but ultimately I believe it’s the right thing to do. The WTO’s first ruling that Airbus subsidies were illegal came in 2010 and there has been a long chain of argument and counterargument since then… ending in the most recent WTO ruling, under which the US is entitled to apply tariffs and is right to do so. It’s rare that I see people arguing that President Trump should *not* follow international law but this appears to be one such case.

Hi Paul. Thank you for taking the time to intelligently write out a detailed response from your perspective. And for keeping it civil! As a writer who is “sticking his neck out” on a political issue (not my usual turf, can you tell?) you might not realize it can be a bit terrifying given how the internet so often works. However, I feel it was necessary to bring this issue to light for the many readers I have who enjoy wine but don’t realize what’s about to happen (and mind you, many of them are middle-class, hardworking folks who find a good $20 wine with dinner to be their week’s highlight … I do too! I don’t write about “$900 magnums from Napa wine caves” … a whole other stigma issue the industry is dealing with, but I digress).

Also, please do not take my exclusion of aerospace workers in the article as a sleight. I merely write about what I know, and I don’t know their world … but I certainly respect what they do and what they contribute to the American economy.

I also understand that this is just how it works within the WTO. However, the thing I keep hearing from my industry contacts that is most scary for the American economy is the small, hard to measure trickle-down effects these tariffs will have across the restaurant and retail sector in particular. It’s not Prohibition, but it will come close in terms of devastate everything from wine shops closing entirely, distributors closely entirely (think: warehouse jobs, drivers) and restaurants shuttering. (Most restaurants don’t make money off of food; they make it off of wine … if you are an Italian restaurant, it is hard to do that without Italian wines). Even waitstaff regularly taking home smaller tips will trickle into the economy. Finally, it should be noted that many unique, not-substitutable food products featured on many American menus (Parmigiano-Reggiano, Prosciutto, etc.) are already being tariffed and are included on this list for a heavier tariff, too. That’s another industry impacted.

Wine industry veterans have also noted that tariffs often aren’t short lived, especially on a heavily regulated product like alcohol. The damages sought thru the WTO (I’ve seen $11 billion) will be recouped on the backs of a different and devastated industry, and then what? They’re lifted? Not likely. The damage will continue as (from what I’ve gleaned) it will take decades to rebuild the market. And even if China doesn’t pick up the slack — and this does indeed hurt European farmers, who, yes, have their own ways of being heard with their elected leaders — many of the most beloved products in this industry will go away because the family farmers in Europe who make these unique wines (often from indigenous grapes that don’t respond as well to California’s climate, or wines that are made under very unique climatic conditions) they will go out of business. Gone, perhaps, forever. I’m not being a Polyanna on this. The creation of these products is very fragile and unforgiving.

Yes, it’s complicated. No, I am not anti-aerospace. But (a) the dramatic impact these tariffs will have on this sector of the economy should be known far and wide, and (b) if there is any other course of action that can be taken to protect this group of American workers AND help the aerospace industry, it needs to be pursued. The wine industry, I feel, would likely want this, too. That solution is perhaps beyond my pay grade, but if I can communicate (a) and urge our leaders to be more creative to pursue (b), then I’ll do it. I hope I have your support in that regard.

Take care.